With C.o.R.E.3 beginning next week, the Tokemak team has lined up a series of AMAs ("Ask Me Anything") with various Reactor candidates.

The Spotlight Series will allow the Tokemak community to familiarize itself with the protocols that are interested in securing a Reactor of their own, and get a peek into why these DAOs are so interested in moving away from liquidity mining in favor of sustainable liquidity.

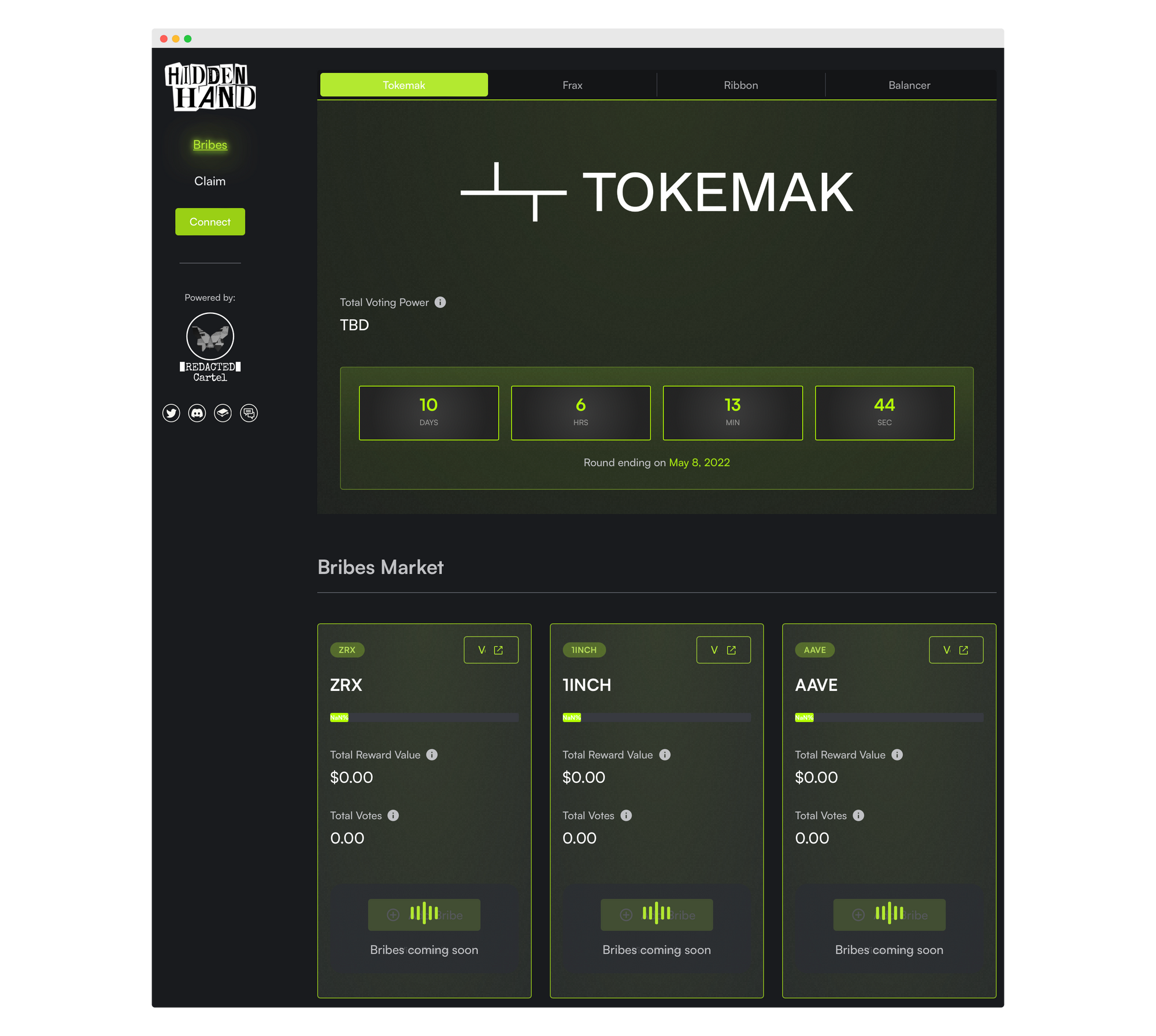

Next up is Redacted Cartel, a meta-governance protocol responsible for the bribing marketplace known as Hidden Hand (which recently acquired Votemak), Pirex, and Racket.

[REDACTED] is a DeFi application that creates novel governance infrastructure that helps facilitate participation, boosted rewards, and DAO2DAO collaboration. The application grows its influence across the DeFi ecosystem through a Harberger taxation model and sources revenue through three flagship products: Pirex, Hidden Hand, and Racket.

For more information about Redacted Cartel:

C.o.R.E. Spotlight Schedule

- StakeDAO - Monday April 25, 9:30am PDT

- Angle Protocol - Tuesday April 26, 9am PDT

- Silo - Wednesday April 27, 10am PDT

- Redacted - Thursday April 28, 10am PDT

- Rook - Friday April 29, 11am PDT

- DODO - Tuesday May 3, 9am PDT

- Immutable X - Tuesday May 3, 5pm PDT

- Paladin - Wednesday May 4, 10am PDT

- Goldfinch - Wednesday May 4, 11:30am PDT

- Badger DAO - Thursday May 5, 11am PDT

Alternatively, the recording is available on SoundCloud.

Key Takeaways

- Sami is a co-founder focused on the non-technical side, such as growth, business development, and marketing.

- Never is a co-founder working on the technical side and policy.

- RealKinando was the first dev on the team and is focused on research for v2 of the protocol.

- Redacted's current products are Hidden Hand, Pirex, and Racket.

- Pirex is a liquid wrapper for vote-locked tokens that enables selling bribes or votes.

- Redacted mainnet launched ~4 months ago as a sub-DAO of Olympus designed to bond in governance tokens.

- Redacted's primary mission is to absorb as many influential tokens as possible, to become the de facto metagovernance protocol.

- A Redacted Reactor would create a source of yield for BTRFLY holders and make the token much more liquid.

- Votemak was originally a fork of Votium before being acquired by Redacted. The team saw a need to create a generalized bribe marketplace that can be used for multiple protocols.

- Hidden Hand supports Frax, Ribbon, Balancer, and Tokemak.

- Hidden Hand can be used by DAOs to further incentivize token holders to vote for a particular Reactor.

- DAOs can deposit assets into a Hidden Hand bribe pool. During C.o.R.E., users can check the marketplace for bribes and vote accordingly. After the event ends, users can claim votes. No delegation is required, and no action needs to be taken outside of voting on Tokemak to be eligible for bribes.

- In the future, Hidden Hand will be updated to enable bribes beyond just C.o.R.E. – for example, to incentivize liquidity direction.

- Redacted strives to be a revenue-generating DeFi Lego by continuing to launch business-facing products.

- Hidden Hand is now live! Check back during C.o.R.E.3 to see available bribes.

"[Tokemak] for us is a super influential asset beyond personal benefits of the protocol. It's something that other DAOs want to accumulate to make sure that once permissionless Reactors come around that they can use to direct liquidity across the entire DeFi space." – 0xSami

[00:00:00.250] - CJ

All right, everybody, thank you again for joining. This is our fourth CoRE Spotlight AMA. Today we have Redacted and a couple of the team joining us. We have Sami, RealKinando, and Never Defined. Gentlemen, welcome.

[00:00:16.670] - 0xSami

GM, thanks for having us.

[00:00:20.270] - CJ

So, to kick things off, could you give us a brief introduction to Redacted? And if you could just explain briefly what each of you do for the protocol?

[00:00:33.130] - 0xSami

Cool. Yeah. I'm Sami, one of the co-founders. Mostly I focus on the non technical side. So helping out with growth, marketing, strategy, BD, all that sort of fun stuff.

[00:00:46.810] - Never

Yeah, Never Defined, short "Never". I'm more of like, a technical co-founder. I deal with tech with RealKinando, and policy.

[00:01:00.930] - RealKinando

I'm RealKinando, first dev on the team. Sami got me [...] I'm working on CoRE v2 and protocol research.

[00:01:12.030] - 0xSami

Awesome.

[00:01:12.480] - CJ

Thanks for the background. Could one of us give you...excuse me, could one of you give us an explanation about Redacted, like how it got started, what led to the formation, and...what you guys hope to achieve?

[00:01:27.990] - 0xSami

Yeah, for sure. So...Redacted is a protocol on mainnet that launched, like, three to four months ago. We originally launched as a sub-DAO of Olympus that sort of leverages the bonding mechanics to pull in influential governance tokens, one of which being TOKE. And as the protocol launched, it entered this sort of, like, hyper bootstrapping phase where we were essentially emitting our governance token out to those who would trade, like, influential governance tokens into our treasury.

And recently, we sort of hit the $100 million in the treasury in different assets, and we've sort of now transitioned into a more conservative protocol. Instead of focusing on, like, hyper bootstrapping the treasury, we're putting out governance infrastructure, which I guess we can talk about on this call, too...governance infrastructure that other DAOs can leverage to...help build their sort of, like, governance tooling. Right. So one of which is...Hidden Hand, which we'll talk about today. And then the other is Pirex, which is essentially like a liquid wrapper for all vote escrow tokens.

[00:02:44.830] - CJ

Cool.

[00:02:45.240] - CJ

Looking forward to learning more about those products you're working on. And definitely, I think, Hidden Hand will catch some interest here today. You mentioned that you are looking to acquire valuable governance tokens. I'm wondering why you decided to include TOKE as one of those tokens that you're trying to stockpile.

[00:03:03.990] - 0xSami

Right. I think a better word than valuable is influential. So...the assets that fit in this bucket, I guess, of influential are ones that have governance power that expands into liquidity direction. Right. So, like...on the topic of TOKE, for us, this is like a super influential asset, I guess, beyond just...personal benefits of the protocol. It's something that other DAOs want to accumulate to make sure, I guess, when the permissionless Reactors come around that they can use as a way for them to direct liquidity across the entire DeFi space as well as these CoRE events. Right.

[00:03:47.640] - CJ

Got it. Yeah. It seems like word of mouth has gotten out. We've gotten pretty good traction from a handful of DAOs, fortunately. So it's always nice to hear that other people see the vision in what we're building and either want to contribute, participate, or take advantage of the DeFi money Lego that we're hoping to build.

[00:04:05.670] - 0xSami

Yeah, right on.

[00:04:06.860] - CJ

All right, cool. I was curious if you could talk briefly about your approach to liquidity, what you've done, what you've looked into, and how you think a token Reactor might help you in that regard.

[00:04:22.100] - 0xSami

You want to take this one Kinando?

[00:04:23.960] - RealKinando

Yeah, sure. When we launched Redacted, we did, like, a huge treasury bootstrapping event, and we raised quite a lot of capital. I think what we did was we put roughly, like, a million of capital on either side into a Sushi pool. It was like half OHM, half BTRFLY token. And then the first...like we kind of stepped into was we're using bonding as a mechanic to accrue influential government tokens, which means there's...a lot of sell pressure.

And the only way to kind of counter that, alongside having rewards for staking, is also having good liquidity. So perhaps right now we're talking about 15% liquidity to market cap. Right. Huge problem was with an OHM pool is we were getting a ton of downside, since we were taking OHM that could have been staked and having the effect of the rebases happening against us. Right. So first idea that we were like...okay, maybe we can mitigate this...is through potentially borrowing on the sOHM, which is...the first kind of solution.

[00:05:29.010]

Right. And then we kind of realized, well, in the process of that, we kind of abandoned LP bonds, which are like a way that a lot of these folks accrue liquidity to actually...doing single sided bonding to then mint BTRFLY to then create the liquidity. That's essentially how we began growing liquidity. Right now we have a ton of Curve looking to bolster what we have with Olympus by using that incident facility from Olympus, which we're actually potentially thinking about using through Tokemak if you guys can integrate it. Yeah.

Having a BTRFLY Reactor would be really interesting because then we'll be able to have all this BTRFLY accumulated in one place, which means liquid to all the BTRFLY holders create, like...liquid yielding assets for BTRFLY holders, especially if you're moving to Redacted v2, where our tokens are locked for 16 weeks if you want rewards. And it would be cool to go to direct all that liquidity into interesting protocols.

[00:06:31.270] - CJ

Sounds great. Looking at ways we could collaborate, I think this would be a good opportunity to talk about Hidden Hand, so I usually like to get a sense of potential collaborations for participating CoRE participants. Hidden Hand, I think, would be a good place to talk about next. Would you want to give us some background on what Votemak was, how it started, what led to Hidden Hand, why someone would want to use it, and...the future of what that product looks like?

[00:07:02.170] - Never

Yeah, I can take this one. Votium was kind of like the first fork of Votium that was tailor made for the CoRE events, and we made an acquisition of it. At first it was very focused on just the CoRE events. But since we're at the forefront of governance, we realized this is kind of the way that the space is going to be going. So it would be very valuable to create like a generalized, bright marketplace that's tailor made to each protocol that's taking on these kind of economics. That's kind of like how we made Hidden Hand. And we want to work with you guys and integrate you as much as possible into it. And we still like...our UI is very general in a sense: that we make sure that the partners feel like they're using their own product, because it is for their own users. And we give you power to whitelist tokens. So only tokens that you deem that will be able to be bribed.

[00:07:55.820] - CJ

So let's say I'm a DAO or a protocol and I'm listening to this call. What exactly is Hidden Hand? How would I use it? Why would I want to use it? What's the benefit to me?

[00:08:07.230] - 0xSami

Right. Let me drop a screenshot here – I guess like an exclusive screenshot. So if you check the CoRE3 channel, this is sort of like what doesn't want the Hidden Hand to control the world. I don't want you to control the world, Bob Boyle. So you have essentially like a UI for people.

[00:08:32.850]

Right. And...I think a lot of people are familiar with maybe how Votium works. Right. For Convex. So essentially you lock up your CVX and you delegate it to Votium, and then you can either claim the bribes or you can do whatever you want with it. Right. The way this works with Tokemak is...because there's no delegation and...it follows these like driving events, the way it works is really simple for users. Right.

So you would go about your business on the CoRE3 page, essentially voting for the protocols you want. But if there's a protocol that really wants to, let's say, make sure they get one of the Reactors, they can come to Hidden Hand and they can add a bribe essentially for your vote. So looking at the screenshot here, the GRX one, just because that's first up an assumption that GRX really wants this Reactor and is depending on a bit more than, I guess, their community to show up. And they want to make sure the Tokemak community feels exposed to their TOKE to vote them in.

[00:09:38.200] - 0xSami

They can come to Hidden Hand, and they can add a bribe in the CRX token, and you would still go about your business and you would vote for CRX in the CoRE3 page. And then after the event is done, you can come to Hidden Hand and you can claim your reward for zero.

You can also extend this out to different sort of combinations of bribes. Right. So let's say CRX and 1inch both put up a bribe. You can split your vote between the two, and you can claim each of them respectively. So I guess this is...an extension built on top of the CoRE3 event. It doesn't change anything to your process or how you would vote. But if you're looking to get, like, incentivized for your vote...let's say you're, like, neutral on who gets a Reactor. You could come to Hidden Hand and you could see the different rewards that are available for your vote.

[00:10:32.150] - CJ

Awesome. Thanks, Sami.

[00:10:34.000] - CJ

Real quick: RealKinando, could you turn your microphone up or get a little closer? I think some people are having trouble hearing you.

[00:10:39.710] - RealKinando

Can you hear me better now?

[00:10:41.580] - CJ

Yes, the audio is definitely better now. Thanks.

[00:10:43.840] - RealKinando

All right, sweet.

[00:10:45.250] - CJ

So Hidden Hand for Tokemak makes sense if there's going to be protocols interested in paying to incentivize TOKE stakers to vote for them in certain events. Is Hidden Hand just for Tokemak CoRE events, or are there other protocols or other uses for that platform?

[00:11:05.810] - 0xSami

Yeah. So right now it's a soft launch with ribbon balancer and FRAX. I think all fans of Tokemak for their sort of like, vote escrow token model. Right. It doesn't necessarily have to be for vote escrowed TOKE, but like, in the case of Tokemak...you can use it for like, a vote escrow token and essentially create the...incentive marketplaces for votes on their platforms as well. But yeah, it's also coming out to a bunch of other protocols. Obviously the first big one is going to be for Tokemak here. We're also doing it for the Citadel Knighting Ground. We've talked with a few projects like cross-chain and multichain, and essentially anyone that has true governance power to their token – a system in which you can direct emissions. You can use this platform to essentially make sure your token holders feel...incentivized for their vote.

[00:12:04.370] - Never

And it's just accruing value to your TOKE.

[00:12:08.890] - CJ

Awesome. That sounds great. And let me know if you have any questions if you want to hop in. Feel free to anytime.

[00:12:14.990] - RealKinando

Another thing I was going to say is it would be really cool to add a feature to Hidden Hand where...as well as using it for call events, we'll actually be able to use it for liquidity directing...that'd be a really cool way to integrate Tokemak. I was talking shop about it as well, so we'll definitely do that in the future.

[00:12:31.520] - end0xiii

Yeah, that sounds like a pretty good use case outside of the CoRE events because obviously we're not really sure how many more CoRE events that we're eventually going to run. I mean, ultimately we want to get to the point where we can have permissionless Reactor spin-ups. But yeah, that sounds like an interesting alternative use case.

[00:12:51.430] - CJ

Totally. So gentlemen, if Redacted achieves everything you'd like to achieve in whatever time period, 12 months, 24 months...what does the most successful vision of Redacted look like, and what will it take to get there?

[00:13:08.930] - 0xSami

Yeah, I think this is like an interesting question because I think a lot of projects imagine themselves in like 10 years sort of making DeFi super-accessible for everyone. But I think for Redacted we want to be sort of like an assassin. Almost like if you were to make...a traffic comparison where Redacted sort of lives behind the scenes, creating revenue-generating infrastructure that other DAOs can use to power their protocols. So I don't think we're too much of a user-facing product – rather like a business-facing product. Right. And what that looks like or how we get there is by launching more products like Hidden Hand. Right. Keep on creating new infrastructure for people to tap into and use as a money Lego to make their products better. And we're sort of there just like enabling this for DeFi to happen.

[00:14:07.660] - Never

Got it.

[00:14:08.570] - CJ

One question from the audience: is Hidden Hand live? And if so, where could someone go to take a look at it?

[00:14:15.630] - 0xSami

Yeah. So the page, the Tokemak page is not live yet. Oh, looks like it is! I guess it just went live today. I'm going to drop the URL here. It seems like Ghost already sent it. So yeah, you can go check it out and play around with it.

Like I said, for the soft launch, for the other three protocols, there's like one or two bribes that you can play around with. We're still like whitelisting different protocols, but I think the main focus right now is on the CoRE3 event and the Citadel event. So the other three are...mainnet instances you can play around with. But yeah, you should start to see different incentives flow in for different Reactors over the...damn, we got a lot of projects here! Like a ton of projects here. You'll start to see the incentives start to flow in, and then as CoRE3 launches again, just go about your business...and at the end of the event you can come back and claim your fair share of the rewards, depending on the protocols you voted for.

[00:15:21.530]

Awesome. And just for our listeners, hiddenhand.finance/tokemak is the URL.

[00:15:30.570] - 0xSami

Will you be disallowing bribes for anything but Redacted? No, only TracerDAO is the only one we're disallowing bribes for. Ha!

[00:15:40.150] - CJ

Asked by Bob Boyle. Obviously a huge Tracer bull, for those in the know.

[00:15:47.090] - 0xSami

Anyone could buy. Right. So the way we set it up is that we set up the Reactors for everyone. Everyone has a dedicated page that's participating, and all their tokens, like relative governance tokens, are whitelisted to come in and deposit the bribe. And yeah, it's open for anyone who's...participating. So you don't delegate like we do for voting. No, you don't. You would just go to the Tokemak page and vote for the relative protocol. And once the event is done, you can come back and claim the reward.

[00:16:16.980] - CJ

So I got another one for you. Many months ago, I started to see very confusing tweets that I didn't understand. And that was the early days of Redacted marketing. I was not in the know, didn't know what you guys are doing. It was super secretive.

Who was responsible for that campaign or even the branding? Overall, I'd love if you could talk about sort of the vibe, the ethos you're creating...the themes you've been playing with. Curious...who is responsible for that and what led to that style being displayed so prominently?

[00:16:52.970] - 0xSami

I think Redacted, like I said before...when you choose to go the DeFi native route rather than the more retail-appealing approach, if that's the right word for it, you're allowed to be a bit more flexible with the brand because you're making products that are directly appealing to your market.

And for us, our market, like our end users, are actually like other DAOs, other protocols. That means that we can be a bit more creative and crypto-native with the way we approach...comms and stuff like that. I guess who's behind it? Like the whole team was behind it. There wasn't necessarily like one person who did it or like a marketing agency or anything. We just want to launch a bunch of cool shit and just have fun while we're doing it. Right. We don't want to be boomers. Heh.

[00:17:45.470] - Never

Yeah, I think he's trying to pinpoint the guy so he can poach it. Ha!

[00:17:49.250] - CJ

Exactly.

[00:17:51.050] - RealKinando

I think it began with Sami, because when Sami was introducing people to the idea of Redacted, he was like...redacting all the cool details. He said, oh, yeah, like an evolved Curve, and there's tons of yield. And then we were just like, okay, we're redacting all these. Let's just call it Redacted. And that's basically like the stem of the marketing.

[00:18:07.740] - CJ

Every time I ask RealKinando for leaks, he just sends me a bunch of blacked-out text and I get nothing. So it's strong regardless of what form you guys are communicating.

[00:18:20.300] - RealKinando

Loose lips sink ships. You know what I'm saying?

[00:18:24.210] - 0xSami

I like Tokemak branding too. Like, you guys did good with your branding too.

[00:18:28.260] - end0xiii

Yeah, thanks.

[00:18:28.870] - CJ

I think InternetPaul gets a lot of credit for that one. We've gotten a lot of enthusiastic responses and, yeah...pretty engaged community. So it seems to be working out so well, pretty well, thus far.

[00:18:43.720] - 0xSami

Right on.

[00:18:44.820] - Never

All right.

[00:18:45.940] - CJ

So looking at the CoRE3 channel, if anyone has questions...anything you'd like to add, or if the Redacted team asks questions for us too, it is an AMA. So there's no harm in asking questions both ways.

[00:18:58.320] - 0xSami

Right? I mean, you know, we obviously are like: what's the URL which says like the DAOs that hold TOKE... Warbase? Tokebase?

[00:19:07.740] - CJ

I think it is now wars.tokebase.org.

[00:19:13.710] - 0xSami

Nice long URL, if you check this website out. We've been building a TOKE position since launch, actually looking at this, like we are in the lead right now with the biggest TOKE holding out of any DAO in DeFi, which is super dope.

And for us, we're in a position with some of our partners where we're going to be making a big push for the Reactor, whether it's through leveraging our TOKE holdings or like a partner's TOKE holdings or like the Hidden Hand platform. Right. And then I think after that...when we expand to a new ecosystem, we always want to come with value to bring. We're not just here, just like...buying the token. Like if we're buying the token, we have very high conviction in the platform and that's exactly what we did with Hidden Hand. Right.

So instead of just...coming in and participating in the TOKE Wars, we're out here facilitating them, and that obviously gets us super excited. And after CoRE3, I guess the question is: what comes next for Hidden Hand? And how can the TOKE users leverage this platform to get more out of their TOKE?

[00:20:25.650] - 0xSami

And I see a question here...let me find it. Will Hidden Hand work only for the CoRE events and the permissionless token Reactor or for the Liquidity direction both as well?

Actually, Liquidity Wizard is one of the advisors to Redacted, and we work with them super closely trying to figure out the best way to rework Hidden Hand into something that can be used for the everyday TOKE user beyond just like these one-off CoRE events. Right. So I think the way we're imagining it is people who hold TOKE can come in onto the Hidden Hand platform after, and see the different incentives that other projects are putting up...and utilize those rewards to sort of dictate where people are voting for their LD emissions. So there's definitely a ton of stuff we can do with Hidden Hand after the CoRE3 event. And I think this is just like the big bang. Right. This is just like the beginning of like a ton of collaborations to come. Yeah.

[00:21:31.530] - CJ

Dig it. Can you touch on Pirex? And then someone asked what else is in the pipeline after that?

[00:21:37.900] - 0xSami

You want to take Pirex, ND?

[00:21:41.010] - Never

I mean, from the threads that we've been posting out. Pirex is a liquid wrapper for vote lock tokens. Starting off with Convex, we have better liquidity for some liquidity in there, so you can trade your future bribes through our marketplace as well. So it's not just a liquidity wrapper, but you can play it as much as you want. So you'll have like a liquid wrapper that's accruing to you on the pxCVX token. But if you want to take it a step further, you can [...] up to the lockup time so that you can sell your bribes or your votes like 16 weeks in the future. And I guess you can do whatever you want with it, so it opens up like way more possibilities so you can actually leverage up, let's say on CVX if you sell your future bribes, buy more CVX loop through that. So I don't know. All those strategy makers can show.

[00:22:31.590] - 0xSami

And...what's next? Without getting too into it, I could definitely see, eventually, a FRAX market for TOKE. So what that means is like essentially splitting these future rewards and emissions you're getting from something like Hidden Hand and like the underlying token, and then letting people sort of trade the future rewards as futures...essentially like native into the platform. So creating a bit more like exotic liquidity around liquidity direction is definitely something we've put a lot of thought into. And you know, you guys just fit perfectly into what we imagine the whole DeFi space moving towards. So obviously more accumulation, more use cases of Hidden Hand, Pirex markets. I'll go into more stuff of what we're doing. But this is the big push for us like right now. And I think all three of the initiatives we're doing fit perfectly with what's going on with you guys.

[00:23:30.690] - CJ

Yeah, I expect plenty of collaboration in the coming months. So super on board with what you guys are building and how it overlaps with our protocol. Hopefully a core DeFi Lego in the system and plenty of people build on top of us, use us for their strategies. The future is super exciting.

[00:23:47.730] - 0xSami

Appreciate the kind words, King. I love Bob Boyle's, like, bull posting here at the discord.

[00:23:53.510] - Never

Bob's a character.

[00:23:54.480] - CJ

There's actually like ten people that run that account, I think, so I don't know which Bob we're getting.

[00:23:58.750] - 0xSami

Yeah, I just see it everywhere.

[00:24:00.230] - CJ

It's confirmed there's multiple Bobs. It's like Robert Paulson and Fight Club.

[00:24:12.010] - end0xiii

The thought of there being multiple people running the Bob Boyle account is hilarious.

[00:24:17.650] - CJ

I don't know which one I met at Denver in February, but I like that one.

[00:24:24.550] - end0xiii

Anyway, I haven't been speaking too much, but I just want to echo what CJ was saying. Very exciting about the collaboration, and we're super stoked that you guys are excited about Tokemak and taking such a strong position and having such faith in us. So we're pulling for you guys for the CoRE3.

[00:24:49.510] - 0xSami

Yeah, man. I think we have the resources behind us to make it happen. We've built out a super strong conviction position. We have the platform, we have the resources, and we're going to be making a big push for it. So actually what's dope, too, is I think this is really useful for the expansion out of the OHM LP. But you guys are doing the gOHM Reactor also, right? Or like the gOHM base pair. So we are also one of the protocols that paired against also. So I can imagine us being like one of the first users of that, too.

[00:25:23.930] - RealKinando

Oh, yeah.

[00:25:24.410] - end0xiii

That's interesting.

[00:25:25.420] - 0xSami

That's cool. Yeah.

[00:25:26.720] - CJ

I'm not sure we've released a timeline for when Liquidity Directors will be able to choose which pair asset they want to use. But gOHM is definitely an option, and it sounds like you guys might be the very first one to use them.

[00:25:38.310] - 0xSami

Yeah, I think there's a bunch of options here, like 4pool. We're also really involved with that, like gOHM. We are the ones using that kind of stuff, too, with the Liquidity Directors. That should be really fun to play with. I guess we kind of work in the same vertical, but approaching it differently in a way that we can collaborate on just making each other's product better. It's kind of dope.

I think a lot of people don't necessarily recognize the importance of influencing liquidity direction...all this sort of stuff...until the whole industry clicks. Right. I think a lot of people are just like a bit more used to these user-facing things. And while both of us are things that people can use, I think the thesis behind both projects is very well aligned.

[00:26:36.480] - CJ

Yeah, I think so, too. Clearly, people are fired up for this, so this is a lot of activity. Let me see if there's one more question we can get to. Will the launch of v2 BTRFLY affect Liquidity Directors, if at all, will it be a different token? Is v2 BTRFLY, gBTRFLY or what might be that?

[00:27:01.610] - RealKinando

What we're doing is right now, like with Redacted, we have xBTRFLY. Right. Which is very similar to sOHM in the sense that you stake it and you're getting the rebases. We're eliminating that. But we're keeping the same underlying BTRFLY token that we had from our launch, so it wouldn't affect anything through the Reactor because the liquid BTRFLY token is the exact same.

[00:27:25.410] - end0xiii

Got it. Did you guys have any ideas about if you would do anything with the tAsset derivative? Any use cases for that? I don't know if that was mentioned yet.

[00:27:38.990] - RealKinando

It kind of creates like a liquid yielding wrapper for BTRFLY Road, because now that we're moving from this staking, like an OHM fork model to something which is more like a veToken, it kind of makes sense to have as many liquid wrapper options for users to get yields in a more liquid way. So the tAssets, obviously they have one week lock effectively, so it's a lot more liquid. What would be cool is to see whether we could figure out how to enable users to double their [...] to figure out...how could they get yield through Tokemak and also to another protocol product. So, I mean, that's something that we're playing around with right now. I don't wanna leak alpha.

[00:28:20.850] - CJ

Cool. Well, I'm super excited you guys are in CoRE. Given that on the wars.tokebase page you're the number one holder of TOKE, I assume you'll have a fairly good chance of winning a Reactor. So good luck to all of you.

If someone wanted to keep tabs on your progress, where would they go to stay in touch or just learn more about what Redacted is up to?

[00:28:47.490] - 0xSami

Yeah, find us on Twitter at Redacted. Like how you usually spell it "cartel". How you usually spell it on the page. There's a yat you can click on the yat -- it's a caterpillar turning into a butterfly...and then there you can find all our stuff.

We have new v2 docs coming out with the new transition of the platform from a treasury base token to this new vision for the platform. You can find the docs there. You can go there. You can find different stuff that we rolled out for a contributor program. Like how you can get involved too.

If you want to get more involved, there is Hidden Hand stuff that's a bit more relevant here. The website is live now. As you guys saw, I posted it in the CoRE3 channel. We're currently coordinating how this looks like rolled out...but then you guys will be flooded with information on how to navigate it. But it's very simple. The TLDR is just like use CoRE3 how you'd use it, and then you can come check Hidden Hand after to see if you got any rewards, or vote accordingly based on the rewards.

[00:29:52.350] - 0xSami

So yeah, stay tuned.

[00:29:54.040] - CJ

Love it. All right, gentlemen, really appreciate the time today. Thanks for joining and yeah, pleasure to collaborating with you here in the future.

[00:30:00.910] - Never

Thanks for having us.

[00:30:02.110] - end0xiii

Thanks so much.