TOKE to $420.69, right? Dedicated Pilots know it’s inevitable, but we also know that the market doesn’t go Up Only in a straight line. While most investors are content to just hodl through market downtrends with the hope that it’ll bounce back, more advanced traders may decide to employ clever strategies that reduce downside exposure during periods of market volatility.

Nuke Inbound

Zhu Su tweets "buckle up". Barry brags about longing ZEC -- the signs are there, the market is ripe for a massive nuke. You feel confident that we're due for a correction, but think it'll only be a short term affair and not a multi-month bear.

What options are currently available for Tokemak liquidity directors to hedge their TOKE exposure? Simply bail and take profits? You can request to withdraw your TOKE from the protocol, wait until the end of the cycle, finalize withdrawal, then finally swap to stables… bit of a pain and will likely cost a ton just in gas fees — and with the 24-hour cycles, timing trades would be difficult.

Enter Tracer

Tracer is a new DeFi protocol that allows users to take a long or short position with leveraged tokens. Since inception, the protocol has supported BTC and ETH, but has now introduced support for TOKE.

Perpetual Pools are a new financial primitive that enables anybody to take a short or long position on any underlying asset. These positions are non-liquidatable, fully collateralised, fully-fungible and can exist perpetually without upkeep. These positions exist as ERC20 leveraged tokens which live inside your wallet and are composable within the DeFi economy.

What are Long & Short Positions?

A long position is when a trader buys an asset with the expectation that the price will increase in value, and a short position is when they borrow an asset with the expectation that the price will decrease in value -- by borrowing, you are able to fulfill your sale at a lower cost basis when the price drops, resulting in a profit.

With Perpetual Pools, the complexities of a short selling are abstracted away — users can simply mint a short token in order to take a short position on the underlying asset.

What is a Delta Neutral Position?

A delta neutral position is a hedging strategy that is used when a trader wants to reduce their price exposure during volatile market conditions. This is accomplished by opening both long and short positions of equal size. As the name suggests, this effectively neutralizes your profit and loss from price movements. In other words: profits from one position are equal to the losses from the other position.

Delta Neutral Strategy with Tracer

Tracer’s Perpetual Pools offer a novel method for traders looking to take long and short leveraged positions in DeFi — and with support for TOKE, Pilots can utilize it as a simple method to weather volatile market conditions.

A simple delta neutral strategy would require minting equal notional value of 3S-TOKE/USD to a third of your staked TOKE (e.g. $3.3k worth of 3S-TOKE/USD if you have $10k TOKE staked).

This would result in a balance between your long and short exposure. With equal exposure on both sides of the trade, the USD losses of your staked TOKE are offset by the Tracer short position during downtrends — but, on the flip-side, your gains are offset by the short position during uptrends. You neither win nor lose as far as the USD value of your position is concerned.

The 3p markets allow you to utilize more of your capital for long-term spot holdings, while being able to quickly spin up a delta neutral position without needing to liquidate assets for collateral.

Keep in mind that while higher leverage is more capital efficient as it requires less collateral, it exposes you to more volatility decay.

Leverage should only be used by experienced traders — it’s a powerful tool, but also dangerous to the uninitiated.

Tracer’s Perpetual Pools have been deployed on Arbitrum, allowing this strategy to be an extremely cost-effective way to hedge your TOKE position.

Reap the Farming Rewards

In addition to being more efficient than unstaking and swapping to stables, another major benefit of employing such a strategy comes from the fact that you won’t miss out on TOKE rewards cycles. Since your liquidity directing position remains in place, you continue to earn yield!

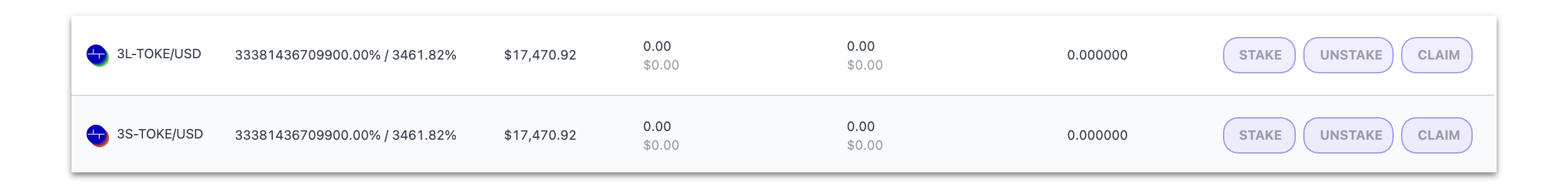

Tracer also allows you to stake pool tokens, allowing you to also earn TCR — however, Tracer staking rewards are only available for 1-week after the launch of the TOKE market.

Risks of Perpetual Pools

Sounds like free money, right? Simply hold a delta neutral position while farming TOKE and TCR! Not so fast — due to an effect called volatility decay, profit is reduced the longer these positions are open. It's best to only keep a position open over short timeframes. This is true for most leveraged assets (including ETH-FLI, FTX's long/short markets, and even ETFs in traditional finance).

Tracer’s v2 implementation of Perpetual Pools aims to drastically reduce the effects of volatility decay, so keep on the lookout for developments.

How To

The TOKE Perpetual Pool market is available at Tracer.finance.

Learn more about the protocol by visiting the Tracer Documentation.

Mechs & Snipers

Tracer was an underdog during the first C.o.R.E., but ended up clinching a reactor spot against tough competition. Clearly, the team and community understand the benefits of Tokemak, and a promising relation is developing between the two protocols.

As we’ve discussed, Tracer’s design allows for minting composable short/long tokens for a variety of assets. Currently, that includes BTC, ETH, and TOKE, but the available markets will continue to grow. A key ingredient to success for such a protocol is liquidity for these tokens, as well as the protocol’s native TCR token — something only Tokemak can offer sustainably.