Written by AlchemixOccultx

In the last few weeks we’ve been hearing a lot about Andre Cronje's new project: Solidly – a.k.a. ve(3,3) – which is the foundational primitive in the accompanying AMM, SolidSwap.

The project aims to introduce novel tokenomics and governance on top of an Automated Market Maker (AMM) or Decentralized Exchange (DEX) such as Uniswap or SushiSwap.

I couldn’t help but to draw a few parallels between Solidly and Tokemak, including in specific tokenomic design decisions, active governance as a feature, and the potential impact these projects have had, and will have on the developing ecosystem.

From what we currently know about Solidly, there appears to be a potential shortfall in the design, and Tokemak may be a strong candidate to assist in ensuring the protocols longevity and sustainability.

The Problem

Before we can talk about some of the aspects Andre is looking to improve upon with Solidly, we have to define the problem that accompanies traditional AMMs and their tokenomic structure.

As it stands, liquidity is very difficult for new AMMs to source. Many protocols will bootstrap liquidity with native token emissions which creates an incentive for liquidity providers (LPs) to step in and deposit their assets.

What has been more clear over the last 2 years or so is that these incentives are very costly in regards to native token supply dilution, but perhaps even worse is that the liquidity they do obtain is temporary. This creates a dynamic where both token holders and LPs act as mercenaries - they show up only when you pay them to.

This, unfortunately, creates instability in both token price as well as availability liquidity.

The (Potential) Solution

Andre summarized a potential design solution eloquently in his recent article about fee distribution in Solidly.

The goal is to align emission to incentives, and the problem with a lot of current AMM designs is that it is easier to incentivize liquidity instead of fees.

Solidly is designed in such a way that only high fee-producing pools are incentivized by $SOLID emissions.

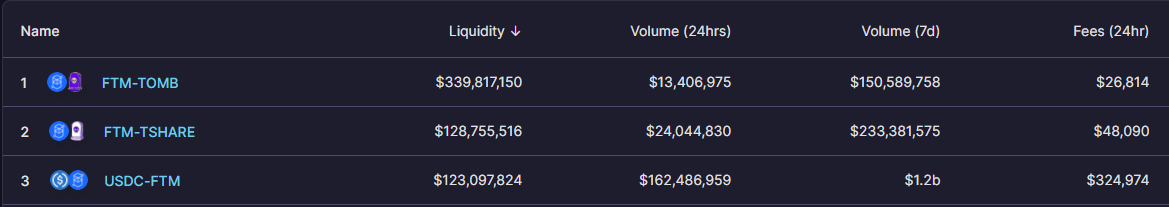

Take for example, this snapshot of SpookySwap’s top pairs:

Here we can see the USDC-FTM pool generates 12x the amount of fees than the FTM-TOMB pair, yet has ⅓ of the total liquidity.

You can start to see the value of tailoring emissions in such a way that is productive for the protocol, rather than being wasted on pools which are non productive for token holders.

We also see deliberate emissions within Tokemak’s design. While emissions for Tokemak are partly a way to bootstrap and outsource liquidity, the reactors incentivize ‘balance’ between the value of assets deposited and TOKE staked through dynamic emissions.

This gives power to $TOKE holders and encourages active governance.

Active Governance

Arguably the most important aspect of Tokemak and Solidly is the concept of active governance.

$SOLID token holders who are looking to acquire fees generated from the protocol are encouraged to lock their tokens (ve) for a specific length of time ranging from 1 week to 4 years.

This model was adopted from Curve Finance (read more about vote-locking). Users will receive veSOLID proportional to the amount of time designated on the lock.

Simply put, the longer you lock your tokens up for, the more voting power you obtain within the protocol. And because token holders can only obtain fees for the pools they vote for, it behooves thoughtful governance as there is great financial incentive to vote for the highest performing pools.

Perhaps the greatest display of active governance in DeFi so far was both rounds of Tokemak’s C.o.R.E. event. This is where $TOKE holders had the privilege to vote for which projects were to obtain the initial reactors. Because of the massive utility Tokemak provides, it quickly became clear to those paying attention that DAOs looking to get enough TOKE votes had to activate both their community and their treasuries to participate successfully in the event.

Creating a protocol which encourages and incentivizes active governance is not easy, and I’m excited to see DeFi evolve and incorporate intentional design decisions to promote user and token holder involvement.

Integrations and Sourcing Liquidity

Solidly provides incentives for productive liquidity, but that doesn’t necessarily mean the market will respond to it. Andre has made it clear that Solidly isn’t a competitor to existing AMMs, but is actually complementary to them.

Andre explained that existing AMMs on the Fantom network, such as SpookySwap, can integrate the new AMM into their own design while accruing all fees to their own systems without losing volume or liquidity.

It’s unclear how the architecture of the new AMM will support this vision, but it’s a certainty that existing protocols and DAOs will look to take part in the project if fee accrual for token holders is significant.

With intentions for both Tokemak and Solidly to embrace multi-chain, integration between the two behemoths is a possibility. Sourcing liquidity appears to be one potential pitfall for Solidly, and Tokemak could be utilized to do exactly what it’s designed to do - direct liquidity to the SolidSwap exchange!

If it’s not already clear, Solidly and $SOLID holders would benefit massively from deep liquidity. Deep liquidity ensures that aggregators and other users can participate in low slippage swaps. Increase in the depth of liquidity = more routing of trades through the new AMM = increased fees = increased profit for $SOLID holders.

veTOKEnomics

Carson, the founder of Tokemak, has hinted that Tokemak will be embracing ve mechanics.

It makes sense for TOKE to adopt a veModel. Liquidity directors looking to obtain more voting power can lock their TOKE to obtain veTOKE (vote-escrowed TOKE).

veTOKE would grant greater 1:1 liquidity directing power than TOKE, determined by the length of time TOKE is locked. veToken models are potentially stronger by virtue of supply and demand - locked tokens physically remove supply from the market while increasing demand for governance strength.

As active governance is embraced in Tokemak, there’s a monetary benefit for DAOs specifically to lock their TOKE.

With Solidly, weekly emissions are adjusted as a percentage of circulating supply. This is a fascinating example of a simple tokenomic design choice that could lead to drastically reduced supply dilution than the traditional model.

Basically, as more tokens are locked the supply impact of emissions is decreased. Emissions in this model are deliberate, dynamic, and with intent.

The alpha here is that Tokemak could very easily adopt this exact tokenomic model, if it proves to be successful.

Alpha from Liquidity Wizard

vetABC > ( veABC || tABC )

— ┻┳ Liquidity Wizard 2.☢️ (@LiquidityWizard) January 21, 2022

iykyk

In this tweet Carson hints at the ‘possibility’ (all but confirmed, in my opinion) of vetABC tokens:

- ve = Vote-escrow, locked

- t = Token supply as liquidity within a Tokemak reactor

- ABC = Any asset

To me, this could be interpreted in a few different ways.

When an asset is provided into Tokemak, the user is provided with a tAsset representing their position. tAsset holders are provided voting power within Tokemak. Locking a tAsset is locking liquidity within the reactor as well, ensuring that part of the TVL for the protocol is non-mercenary.

This is an exciting proposition, as it’s a novel way to provide users with flexibility and potential for fiscal or governance incentives when locking their assets. Perhaps more importantly, it adds to the sustainability of Tokemak as a protocol. DAOs specifically may find this an appealing way to decrease the effective emission ‘costs’ associated when using Tokemak as a liquidity providing service.

Unsurprisingly, veAsset tokenomic designs are already making their way through governance forums. For example, a potential revision of SushiSwap's tokenomic structure that includes veAssets. The Abracadabra community has also been discussing the opportunities presented by the model. Redacted Cartel, $BTRFLY, aims to implement a veAsset model which can be used for meta-governance or to provide financial incentives via bribing.

There has been hesitation within some communities to embrace tokenomic structures that incentivize locking. The single largest complaint? You guessed it - these positions are typically illiquid.

Solidly attempts to solve this problem by creating NFTs which represent your locked token allocation. These NFTs can then be sold on secondary markets at whatever price the peer to peer markets deem as a fair value. I assume these positions will be slightly more liquid, but still lacking in composability overall.

While creating liquid veAsset markets still remains a challenge, DAOs themselves could encourage users to delegate their vetAsset votes for bribes through VoteMak. This may help DAOs purchase additional voting power from individual users, likely at a fairly 'affordable rate'.

Users would of course receive more potential voting power per each asset deposited, and therefore would have a larger claim to the designated bribe than unlocked tAssets.

Closing Thoughts

Solidly and the design of ve(3,3) is an interesting experiment trying to address the common pitfalls of the traditional governance token.

It makes sense that the next wave of DeFi may aim to funnel fees and other incentives directly to the token holder. Furthermore, ensuring emissions are both productive and cost effective supports the longevity of the project by reducing supply dilution.

Reverence for the veModel appears to be growing in the community, and if the Solidly experiment proves to be successful then it can be presumed that many other protocols will draw inspiration from their tokenomic design - including Tokemak.

As cross-chain dApps grow in number and size, integrations between them start creating mutually beneficial features. While both Tokemak and Solidly have aims to launch cross-chain, their potential compliments to each other remain speculation.

It will be interesting to see how the veModels change tokenomic design in future protocols and potentially even Tokemak.

Read more about Solidly on Andre Cronje's Medium