In the beginning we wandered web3, or at the time more commonly referred to as crypto, aimlessly in search of opportunities. The early DeFi 1.0 days came, Degens speculated on simple token swaps and engaged in early yield farming. I can remember making some of my first true DeFi moves on PIPT and Yearn. Gas was cheap, DeFi Dad's YouTube favorited, and it was a brave new world.

As DeFi continued to grow and evolve so did the growing concern of liquidity. Degens were like Ronin, masterless and seeking the most advantageous opportunity. Protocols quickly found themselves competing for this mercenary capital which proved to be fleeting. This liquidity concern could distract protocols from their primary objective and was an ever-growing expense.

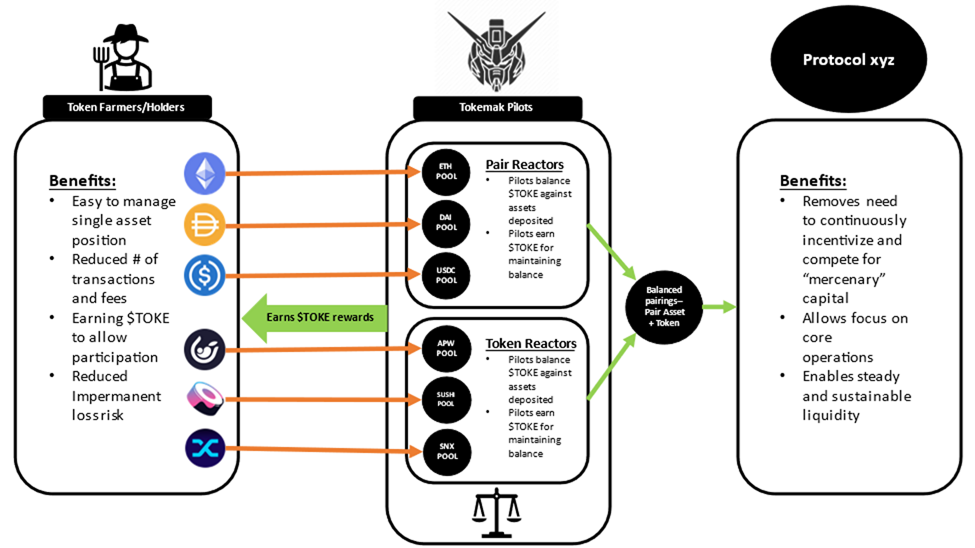

Then came DeFi 2.0 with projects like OlympusDAO, Alchemix, Fei, and of course Tokemak. DeFi 2.0 sought to answer the liquidity problem. What set Tokemak apart was it aimed to offer liquidity as a service and essentially be a black hole for liquidity across web3. I was lucky enough to stumble across Tokemak in a SushiSwap Onsen AMA in August 2021 and enlisted in the Tokemak Pilot ranks that day. Tokemak would offer sustainable and managed liquidity for DeFi. It would act as oil does in an engine, maximizing performance and efficiency. For users and soon to be pilots it offered easier to manage positions and assumed the risk of impermanent loss.

A whole new universe… or should I say Toke-verse opened before me. As the CRV Wars raged we saw a glimpse of a much larger war that had been quietly growing since the beginning: The Liquidity Wars.

Meanwhile, off in the distance, loomed the Tokemak and its Tokemechs. The team was hard at work building and preparing for their entry and the cataclysmic moment ahead. How could I resist? I had to be part of this next chapter. I had to be a Tokemak Pilot.

What is a Tokemak Pilot?

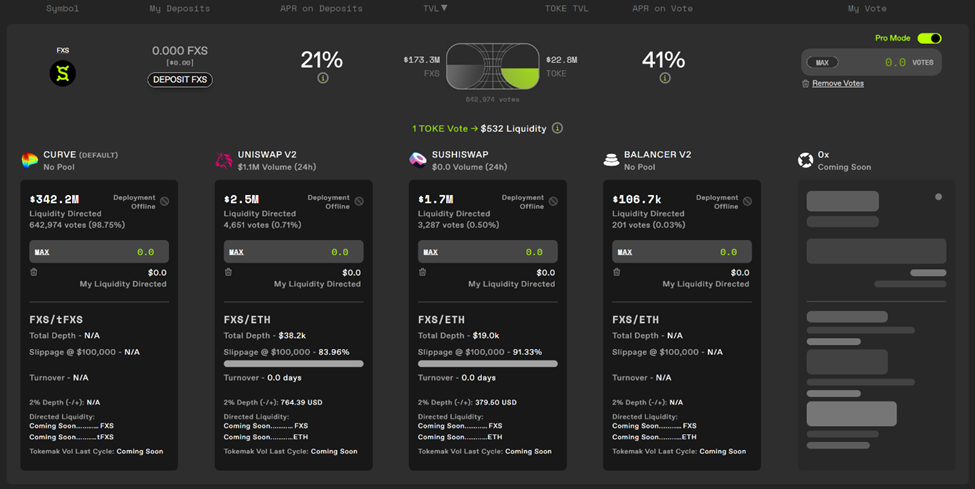

In short, a Tokemak Pilot is an individual staking TOKE on Tokemak. The major difference between this and other staking positions is that a pilot's rewards are directly influenced by their vote allocation which is proportional to the amount of TOKE they have staked. Each vote of staked TOKE is a vote on where the protocol should allocate a proportional amount of liquidity. This is referred to as Liquidity Directing and as of February 3rd 2022 it has begun its controlled launch.

Pilots are incentivized to allocate their vote/direct liquidity to the highest APR opportunity which of course these former ronin Degens are quite familiar with. The advantage is that once TOKE is staked, the act of voting and directing liquidity costs pilots nothing as the transaction is carried out on Polygon. This is where we can begin to taste some of the efficiency Tokemak offers. Namely, the ability to move from one position to the next without costly transaction fees eating into returns.

The earning opportunities don’t stop there though. The CRV Wars revealed protocols willingness to offer bribes to influence liquidity directing. Tokemak has already experienced this on a small scale through its C.o.R.E events where protocols competed for Tokemak Pilots votes. The 2nd event generated $130k+ in profits from $2M worth of bribes which were captured through Votemak, Tokemak’s bribe protocol similar to CRV’s Votium.

This didn’t go unnoticed as [REDACTED] Cartel moved to acquire this lucrative platform in early January 2022. Pilots can look forward to a 3rd C.o.R.E event for bribes before the protocol moves to permissionless reactors. The use of bribes certainly won’t end there though as the attention may turn to incentivizing Pilots to vote liquidity to already existing reactors or to help in the initiation of new reactors. There are numerous possibilities so let your imagination run wild.

Beyond liquidity directing and bribes there is another very exciting opportunity for Pilots. The much-anticipated Tokemak NFT’s. DeGenesis pilots and Tokemechs have been the rumored works in progress but if you have followed the Tokemak team for any amount of time you should know these won’t just be pieces of art… although you can’t deny the team has some awesome style and design. These NFT’s will also likely house utility within the Toke-verse.

Wen ____?!

We have only explored the tip of the iceberg when it comes to Tokemak and its partnerships. There is still so much on the horizon and so much yet to be revealed.

Wen NFT? Wen Airdrop? Wen $BRANE? Wen $MAK? Wot $EXA??? Wen Tokemerch restock?

The questions above are just some of the leaks constantly enticing pilots to dive deeper. Airdrops have long been teased but just what will be airdropped is still a mystery. Will it be NFT related? Will it be related to the Membrane protocol/$BRANE? Maybe a combination of several of these mystery name drops (i.e. $BRANE, $MAK, $EXA)?

At this point we can only speculate, hang out in The Leaky discord channel, and watch for Tratium’s Leaky Sunday recaps where he covers all the alpha leaks the Tokemak team reveals.

This does lead us to the next frontier that will soon open to the Tokemak Pilots…

Wen Membrane?

A closely related but separately developed project from Tokemak is Membrane. Liquidity Wizard has shared that this will be an OTC platform and that the $BRANE token would enable a unified credit layer in DeFi. It is also speculated that the $BRANE token might act as a fee rebate token for the platform.

While excitement swirls around Hurricane Tokemak it is worth diving into 0xParadigm’s Insane in the Membrane for a very well written article on Membrane. In short though, Pilots are preparing for the massive impact that Tokemak’s liquidity and Membrane’s OTC platform will have on DeFi.

Imagine the blackhole of liquidity combined with a platform set up to open DeFi to the OTC derivatives market which was valued at $640T back in 2019. Imagine the impact as this gateway is opened via Tokemak and Membrane especially considering that there is only about $274B moving through DeFi as of November 2019. Not a small amount… until compared to $640T. Imagine the impact of even 1% of that hitting DeFi…

Wen L2?

Before we go to far, I do want to make a quick comment on how impressively built Tokemak’s contracts are considering gas efficiency. As mentioned before, voting or liquidity directing transactions are free. The transactions of staking, unstaking, and claiming are on ETH and in my personal experience some of the cheaper costs compared to other protocols. 100 GWEI gas prices hurt no matter what, but I have found that Tokemak contracts seem to be more efficient in gas.

That being said, the Tokemak team does have plans to expand to L2 with the first expansion just weeks away…

And what about the Curve Wars?

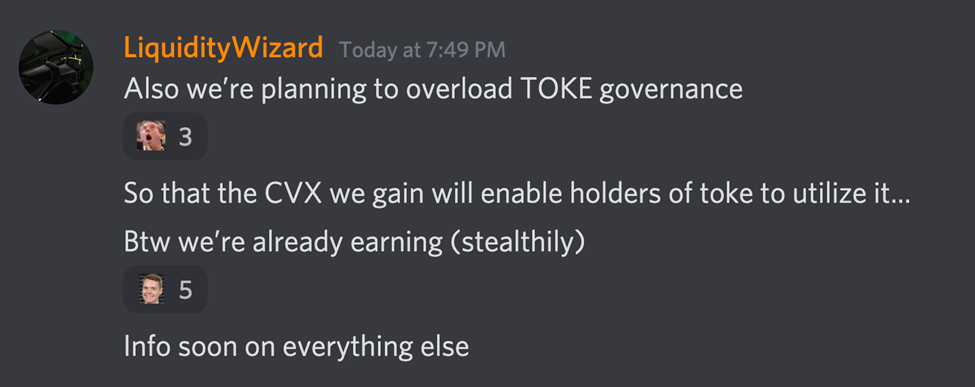

If you have followed the CRV wars at all you know that Convex has the largest control. Well, the Tokemak team is very aware. Just look at the leak from Liquidity Wizard where he teases that TOKE holders will be given access to CVX governance.

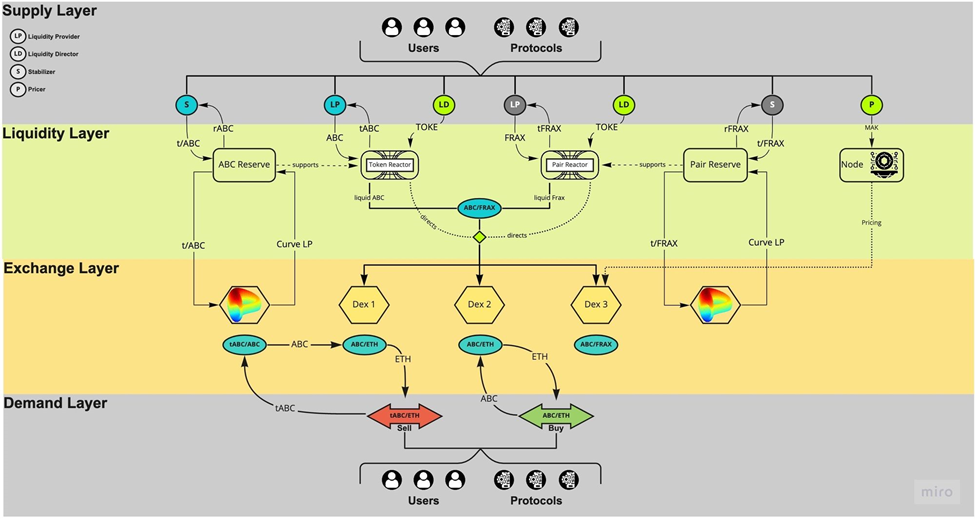

And of course, we can’t forget the diagram Liquidity Wizard leaked a few Sundays ago…

Pilots are currently standing on an endless horizon of possibilities

At the time of this writing TOKE sits at $37.19, has a current supply of 10,012,869, and TVL of ~$1.6B. If we were to consider TVL/supply of TOKE this would imply that a single TOKE is ~$160 worth of liquidity. TOKE’s market cap sits at ~$371M. That’s just some of my observations.

You will also notice that within the various reactors TOKE vote value is depicted at various levels, like the one screenshot further up above at $532. CRV/CVX Governance, Membrane/$BRANE, $MAK, $EXA, L2’s, Votemak, rumored veTokenomics (check out this excellent write-up), progress toward singularity, and NFTs are all just hints of what we know is to come so do with that info what you will Pilots.

Until next time…

☢️❄️ Stay frosty! ❄️☢️