A weekly roundup of what's happening in the Tokeverse

This week, we've seen Danica Swanson join our ranks as a copy editor, details about the third Collateralization of Reactors Event, a new editorial on the liquidity saga from GH0ST, and passionate community discussion about the tokenomic changes designed to put TOKE on the path to becoming a disinflationary asset.

We're also proud to announce the launch of Toke Wars! Built by community members loblolly and tratium, Toke Wars is a dashboard (including an integrated rewards tracker) dedicated to aggregating together all the data Pilots need to understand the major players in the battle for liquidity.

Featured Posts

Hot off the Press

C.o.R.E.3

C.o.R.E.3 [Click To Read More]

What is C.o.R.E.?

C.o.R.E., or the "Collateralization of Reactors Event", provides projects with an opportunity to secure a Reactor. Liquidity Directors & Providers are able to vote on various DAO candidates, and the winners will have a shiny new Reactor spun up, ready to deliver sustainable liquidity.

Bribes During C.o.R.E.

The competitiveness surrounding this event has encouraged DAOs to bribe TOKE holders to vote in their favor. In the past, the top bribes averaged around 10-12¢ per TOKE.

Upcoming C.o.R.E.3

As announced earlier this week, here is the list of upcoming C.o.R.E. participants.

Returning contenders from C.o.R.E.2.: 1INCH, AAVE, ALPHA, API3, AXS, BADGER, BAL, BANK, BIT, BNT, COMP, CRV, CVX, FTM, GRO, INDEX, LDO, LINK, LQTY, LUNA, MATIC, MKR, NEAR, PERP, RAI, REN, RUNE, SPELL, TRIBE, UNI, YFI, YGG, ZRX

New contenders (subject to change): ANGLE, BICO, BTRFLY, CNV, DODO, DYDX, ENS, GALA, GFI, IMX, JPEG, PAL, PREMIA, ROOK, SDT, SILO, STG, SYN

The Future is Permissionless Reactors

We expect that this will be the final C.o.R.E. before permissionless Reactors are supported. Once the floodgates open to allow any DAO to provision a Reactor, the fight to accumulate TOKE will really kick off.

Toke Wars

Tokebase has launched Toke Wars, a platform that showcases the DAOs that are accumulating TOKE, and the value locked & earned in the protocol.

Reduced Emissions

The current crab market has taken a toll on the entire crypto community as it chops traders to bits and causes even the most diamond-handed hodlers to second guess their investments.

Because of this, some drama surrounding TOKE price has been brewing in the #toke-price-discussion channel on Discord.

Since TOKE is used as collateral within Reactors, the team is well aware that maintaining a stable token price is important to the longevity of the protocol.

The team has been analyzing data (a.k.a. checking the chain) to find the main cause of TOKE sell pressure, revealing that TOKE/ETH LPs were the primary culprit.

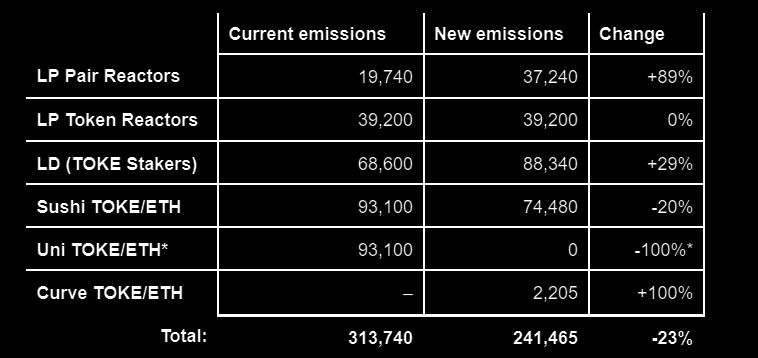

To combat this sell pressure and reduce the overall inflation of TOKE, Liquidity Wizard announced that TOKE emissions across the system would drop over time in three different phases.

Phase 1, which is already in effect, has caused the overall TOKE emissions to drop by ~23%.

Below are the changes in TOKE emissions for this phase. Some drastic changes include reducing the emissions to TOKE/ETH LPs. Incentives towards Uniswap have been cut to 0% and emissions to Sushi by 20%. Tokemak is encouraging users to concentrate their LP on Sushi and deposit assets into Pair Reactors. In addition, a new Curve pool appears to be in the works.

Community Discussion

A summary of in-depth discussions on Social Media.

Marketing Discussion on Discord [Click To Read More]

"Does Tokemak need more marketing to support its growth?"

The community discussed the pros and cons of ramping up marketing efforts. Below is a summary that condenses the viewpoints of the various parties involved in the discussion.

Some members of the community raised the issue on the need for greater marketing to bring traction to Tokemak. Increased marketing would theoretically increase the number of potential investors, thereby increasing liquidity in the protocol and the demand for TOKE. In response, other community members countered by mentioning that the project would attract investors organically once the current guarded phase of initial liquidity deployment has ended.

Tokemak team members mentioned that during the initial phase of liquidity deployment, marketing impact is unlikely to be fully realized. The team's focus is currently on communicating with DAOs. However, they are unable to disclose privileged information regarding these talks until after C.o.R.E.3.

Conclusion

The Tokemak team has shifted focus from broad marketing over to educating DAOs on the benefits of a Reactor, and preparing to onboard them once there is capacity for additional Reactors. Once the protocol enters its growth phase, it is likely that more effort will be made towards marketing on social media in order to appeal to retail investors.

View the original Discord conversation.

More from Discord:

- #toke-price-discussion heats up as the bear market tests short-term investors' nerves.

- 70k3m3ch begins collecting data showing who the dumpooors are (LP sell pressure "dwarfs" escrowed holders).

Noteworthy Tweets:

- Liquidity Wizard hints at "permanent assets" and "rapid PCV expansion".

- Token Terminal launches support for Tokemak.

- 0xPipe threadooors about Tokemak's impressive early revenue numbers.

That's all for this week's Dispatch! Stop by next week for another summary of events.