Not sure what project to vote for during C.o.R.E.? We've put together a summary of the top projects and their value to the system.

Disclaimer: The author (tratium), CometShock, and many of the users quoted below have vested interests in the following projects. The following guide attempts to present these opinions with as little bias as possible, but always do your own research.

First, a preface from @CometShock.

I'm of the opinion that the first five (C.o.R.E.) Reactors should be diverse to demonstrate multiple ranges of experiments that hopefully each succeed in their own right. In DeFi, you can model economics/tokenomics all you want using some of the best people/analysts/software/firms and still fall flat on your face.

Assuming each of these succeed throughout time, Tokemak will be able to address a wider liquidity market with assurances that the model works under various cases. If some fail for various reasons, it provides a learning opportunity and postmortem to iterate and improve. For the pessimists: If diverse projects are chosen, there's also a better chance that at least one will succeed and therefore the project can claim some victory and address the issues found in other areas.

The Contenders

Olympus DAO (OHM)

Olympus started out as a 6-digit APY ponzi, which likely caused many 100 IQ investors to dismiss it entirely. But under the hood, Olympus is perhaps one of the most clever projects in the industry.

Olympus DAO is an attempt to create a stable currency (OHM) through managing a treasury of assets.

- Holders are incentivized to stake due to the high APY, reducing sell pressure.

- Olympus owns 99% of their own liquidity, and the fees it earns contribute to the treasury assets (similar to Tokemak's PCA).

- The total value of the Olympus treasury has grown from $25m to $250m in just 3 months.

- The "Risk Free Value" of the assets backing OHM has grown from $6m to $60m in just 3 months. This means that each OHM is currently guaranteed to be worth at least $29. This may seem low compared to the market value ($700+), but consider that nearly all tokens in existence have a RFV of absolutely zilch.

- By selling bonds, Olympus is able to further grow their treasury.

- By offering Bonds-as-a-Service via Olympus Pro, they are able to accelerate the growth of the treasury by offering their bonding platform and knowledge to other protocols.

How can Tokemak and Olympus work together?

Asfi breaks down the relationship in a thread:

Are $TOKE and Olympus Pro competitors or complements?

— Asfi Ω (3,3) (@ishaheen10) September 29, 2021

A thread exploring the trade-offs from a protocol's perspective between the two approaches.

TL;DR: they are complements IMO and I expect close collaboration between $OHM and $TOKE to continue.

Longer version here: 👇

We do think there will be a much tighter integration than what is described here. For example: tOHM being stake-able in Olympus, allowing users to pool naked OHM in a Reactor and then stake it in Olympus itself. Or the Olympus treasury depositing their 3.3% bond revenue into Reactors... all speculation, but the teams seem very excited about partnering up, so we're optimistic that there is more to the story.

It's no secret that OlympusDAO has been collaborating with the Tokemak core (lol) team, and it (OHM) should rightfully be applied here as a very interesting and unique application. Supporting them will further bolster the collaboration. Supporting them and succeeding together will demonstrate that Tokemak reactors and bonding mechanisms can be mutually beneficial.

Rari Capital (RGT)

Rari offers a suite of decentralized finance protocols to deliver aggregate yield, including isolated lending markets and autonomous yield aggregator ("roboadvisor").

Working with Rari Capital (especially their Fuse product) also poses as a unique opportunity. Most lending markets experience a "chicken and egg" problem with liquidity. No one wants to be the initial seed liquidity because the returns and rates are unknown, and they can't borrow. However, once the initial seed liquidity is there, natural activity tends to spring up because the rates are now known and things can be done instantaneously.

Once the natural activity spins up, then the initial seed liquidity can choose to slowly pull their funds while keeping the lending market from being disturbed. To put it shortly, fresh lending markets tend to just need a jumpstart (lol @ ferRari theme) and then can run by themselves.

Additionally, building out the existing relationship with collateralizing tAssets could prove to be quite interesting and unique! Lastly, their markets will probably be a great continuous source for yield to direct to.

THORChain (RUNE)

THORChain is the only native cross-chain liquidity network. It allows users to swap between L1 assets such as BTC and ETH directly, without using wrapped or pegged assets.

Integrating Tokemak with THORChain would allow cross-chain liquidity directing, tapping into a multi-billion dollar market that is inaccessible to Ethereum/ERC20 bound protocols.

Details of a potential integration are unknown, but in the future could allow for BTC, DASH, XMR, SOL, ATOM, LUNA, ADA and many other Reactors to exist.

THORChain is also known for extremely high yield – 20%+ for the native assets it supports. Supporting THORChain as a liquidity directing venue could result in a Reactor with particularly high yield.

Alchemix (ALCX)

@AlchemixOccultx breaks down the benefits both Alchemix and Tokemak (and Olympus!) would receive from an ALCX reactor:

1/

— Occultist (@AlchemixOccultx) September 30, 2021

DeFi's biggest problem, and biggest opportunity:

There's been an amazing amount of intrigue and support for @TokenReactor @AlchemixFi, and @OlympusDAO over the last few months. This week really kicked off the interest in $TOKE with the first votes on the protocol taking place pic.twitter.com/VSPrSUtaSG

Tracer DAO (TCR)

Tracer offers leveraged exposure to assets – currently BTC and ETH in 1x and 3x short and long positions.

Tokemak needs a smaller, newer project to demonstrate that it can be a useful tool for other smaller, new projects that need liquidity. I generally think that Tracer could fit the bill, as it just recently launched its perpetual pools product and has been distributing TCR, but with not a lot of liquidity at the moment. There are some proposals underway for them to maybe do protocol-owned LP through Visor, and another proposal to maybe start a liquidity mining initiative. Seems like a great unique opportunity!

Illuvium (ILV)

Illuvium is an open-world RPG game built on Ethereum. There have been rumblings of a partnership between Illuvium and Tokemak, but no details are known. Possibly high-quality Tokemech NFTs within Illuvium? We can only speculate. Illuvium has a lot of mindshare in the gaming-NFT space, and could bring additional awareness to Tokemak.

few $TOKE x $ILV https://t.co/2wHnJ1EpuU pic.twitter.com/cNVjzw32Xp

— TOKEMAK (☢️,☢️) (@TokenReactor) September 2, 2021

Love what they're building! IIP coming soon for a potential partnership with $ILV 👀 https://t.co/oiuxjOFx8R

— Kieran (@KieranWarwick) September 2, 2021

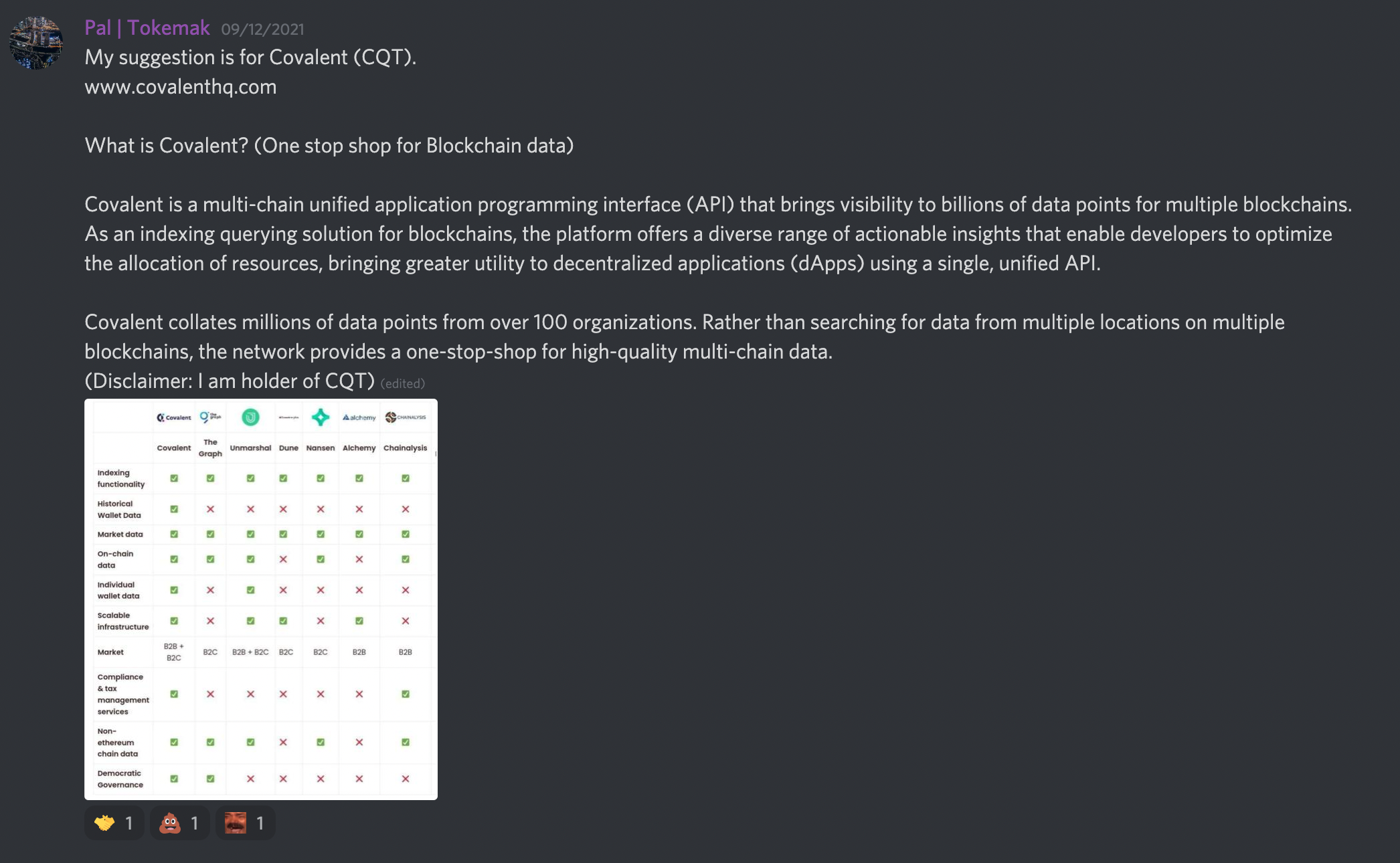

Covalent (CQT)

Abracadabra (SPELL)

BlackPool (BPT)

Liquity (LQTY)

ShapeShift (FOX)

Fei (FEI)

If you are a project advocate, reach out to @tratium to have your pitch listed here!