“The Liquidity Must Come First”

- Catch up on the State of the Reactor summary from October 14.

- The team is continuing to execute on the roadmap. There are no blockers to the accTOKE contract audit, and UI changes are on track.

- The simplified Pair Reactor experience continues to be fleshed out, with additional updates to be released next week. This will allow for a streamlined staking experience while depositing into base asset pools. This change will also increase the efficiency of Liquidity Provider rewards, as there will no longer be Liquidity Directors voting on these pools.

- accTOKE and the sustainable emissions updates are expected to launch in November.

- Protocol Owned Asset deployments from the treasury are ready to be converted to ETH and ETH staking derivatives in preparation for ACC. This is to fuel rewards that will be distributed to tokeACC stakers. [2:00]

- Emissions have been lowered for the Sushi TOKE/ETH pool in order to balance incentives with the Curve pool. Expect continued adjustments as the value between TOKE and the native CRV rewards diverges. [3:30]

- There has been a consolidation of the voting power related to the Curve strategy, allowing Tokemak to have more voting power and drive more yield to the Curve LP while balancing rewards on the Sushi pool. [4:10]

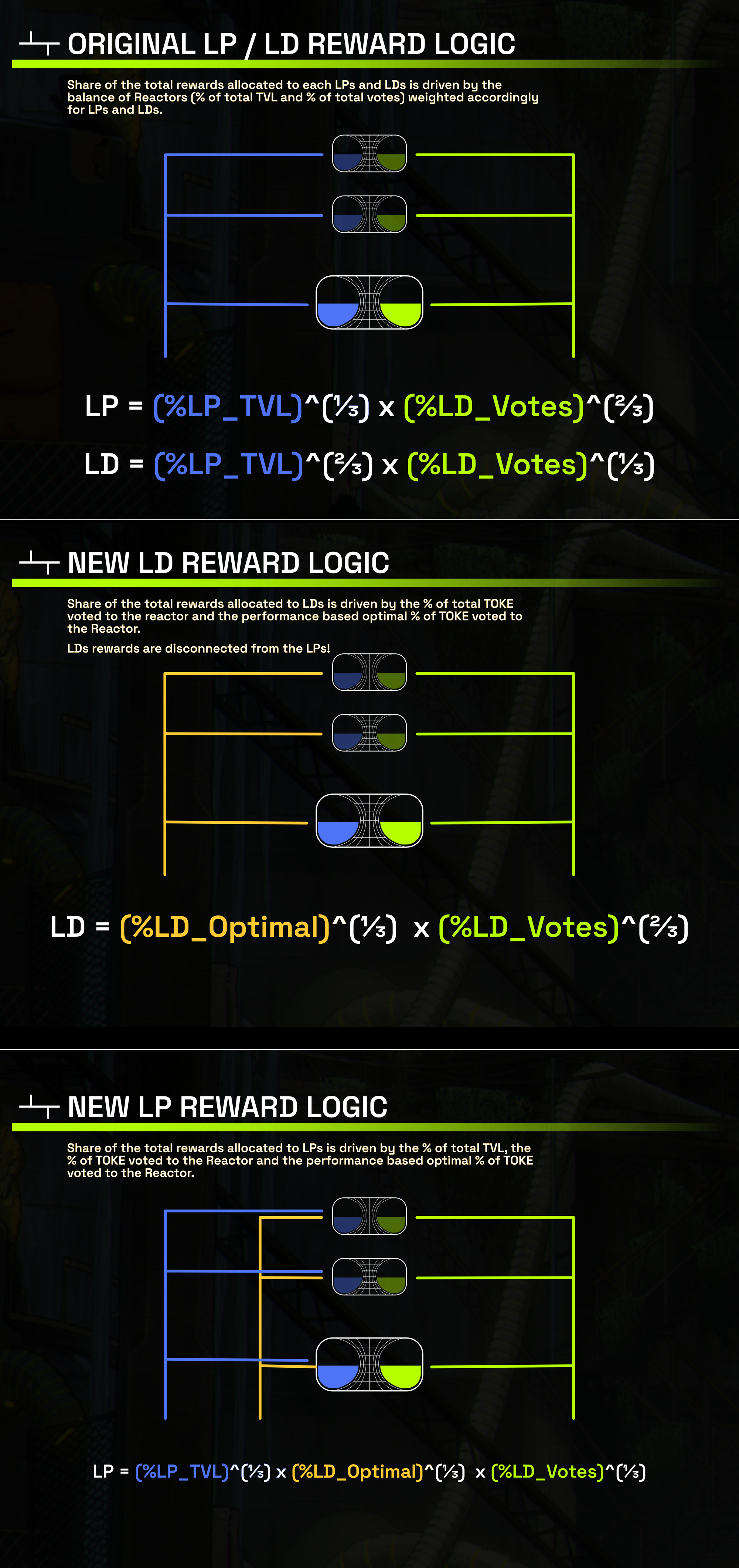

- The updated reward logic was more challenging to implement than anticipated due to a balance of complexity and efficiency, but the team has come up with an optimal design. The logic that was settled upon is as follows: [4:45]

- This new design balances the most efficient vote allocation according to the vote allocation and the desired deployment strategy from Liquidity Directors. This allows for more sustainable emissions, as the system now takes into account the performance of the Reactors. [7:30]

- Liquidity Providers will be incentivized to provide what is optimal to the system, and Liquidity Directors will be incentivized to vote for the most profitable deployment strategies, while retaining the flexibility to vote for their own preference at the expense of lower rewards. [8:00]

- Poorly performing Reactors don’t get explicitly penalized, but the Liquidity Director rewards will adjust to properly incentivize participants. [10:15]

- This solution improves efficiency and outcomes for the protocol, while maintaining the “balance the Reactor” design. [11:00]

- The Gitbook will be updated to include more details on this new logic.

- UI updates are going well, with the final Pair Reactor changes coming in the next couple of weeks, and the accTOKE updates will be ready for the upcoming backend changes. [12:10]

Q&A:

- Question: As communications are improved, will the team be more accurately reporting revenue?

- Answer: The team is in communications with Token Terminal in order to resolve the discrepancy in revenue. [12:55]

- Question: Tokemak already plays a role in providing and arranging liquidity in the crypto markets, which are small compared to the traditional world. What is the expectation of market demand for Tokemak, and where will this demand come from?

- Answer: There is $100T of value transacted in TradFi, and we all hope that eventually crypto will overtake the traditional markets. Tokemak is in a unique position to be an agnostic player, and is positioned to scale with new assets as they require liquidity. As staked ETH derivatives and tokenized assets continue to grow, Tokemak will be in an excellent position to be a key player. [15:50]

- While the treasury is currently being allocated to stETH, it will be diversified into other staked derivatives such as RocketPool staked ETH in the future. Risk assessments are being done in order to safely perform these moves. [22:15]